Why CPA Firms in Middle Tennessee Are Top Targets for Cybercriminals (And How to Defend Your Business)

Imagine the panic that would set in if your CPA firm's entire client database became encrypted and inaccessible just days before tax season deadlines. Unfortunately, this nightmare scenario is becoming increasingly common across Middle Tennessee. In today's fast-paced digital world, accounting firms have emerged as prime targets for cybercriminals, and the consequences extend far beyond temporary inconvenience.

CPA firms in Middle Tennessee face heightened cybersecurity risks that make them exceptionally attractive to cybercriminals. The reality hit close to home when KraftCPAs PLLC, a Nashville-based accounting firm, experienced a significant data breach in February 2025. Unauthorized access compromised sensitive consumer information including names, addresses, Social Security numbers, and driver's license numbers – demonstrating that even established firms in our region are not immune to sophisticated attacks.

Understanding why your firm is a target and implementing robust defensive measures isn't just about protecting data – it's about ensuring your business survives and thrives in an increasingly dangerous digital landscape.

The Perfect Storm: Why Cybercriminals Target Middle Tennessee CPA Firms

Your Firm Is a Data Goldmine

Cybercriminals don't discriminate, but they do prioritize high-value targets. Your CPA firm maintains extensive repositories of highly valuable information that can be exploited for significant financial gain. You hold clients' tax returns, payroll records, financial statements, and sensitive identification documents all in one place.

This concentration makes your firm an "aggregator of data" – both financial and personally identifiable information. A single successful breach of your systems yields multiple victims' worth of information, making your firm equivalent to compromising hundreds of individual clients. The mathematical appeal to cybercriminals is undeniable: maximum return on their criminal investment.

The Vulnerability Misconception

Many mid-sized and smaller accounting practices throughout Middle Tennessee operate under a dangerous assumption: that they're too small to be targeted. This misconception creates a critical security gap that attackers actively exploit. Cybercriminals often assume smaller firms lack robust information security strategies precisely because firm leaders believe they won't be noticed.

In reality, your firm likely struggles with limited IT resources, outdated software, and absence of comprehensive cybersecurity training. These resource constraints create vulnerabilities that attackers can exploit more easily than the sophisticated defenses of larger national firms.

Remote Work Expanded Your Attack Surface

The growing prevalence of remote work has significantly expanded potential entry points for cybercriminals. Your firm now depends on employees maintaining properly configured home routers and current firmware patches – security responsibilities that extend beyond your physical office walls.

Additionally, third parties such as clients and vendors can become entry points for unauthorized access or malware infections that compromise your entire network. Every connection point represents a potential vulnerability that requires active management and monitoring.

How Cybercriminals Strike: Real Attack Scenarios

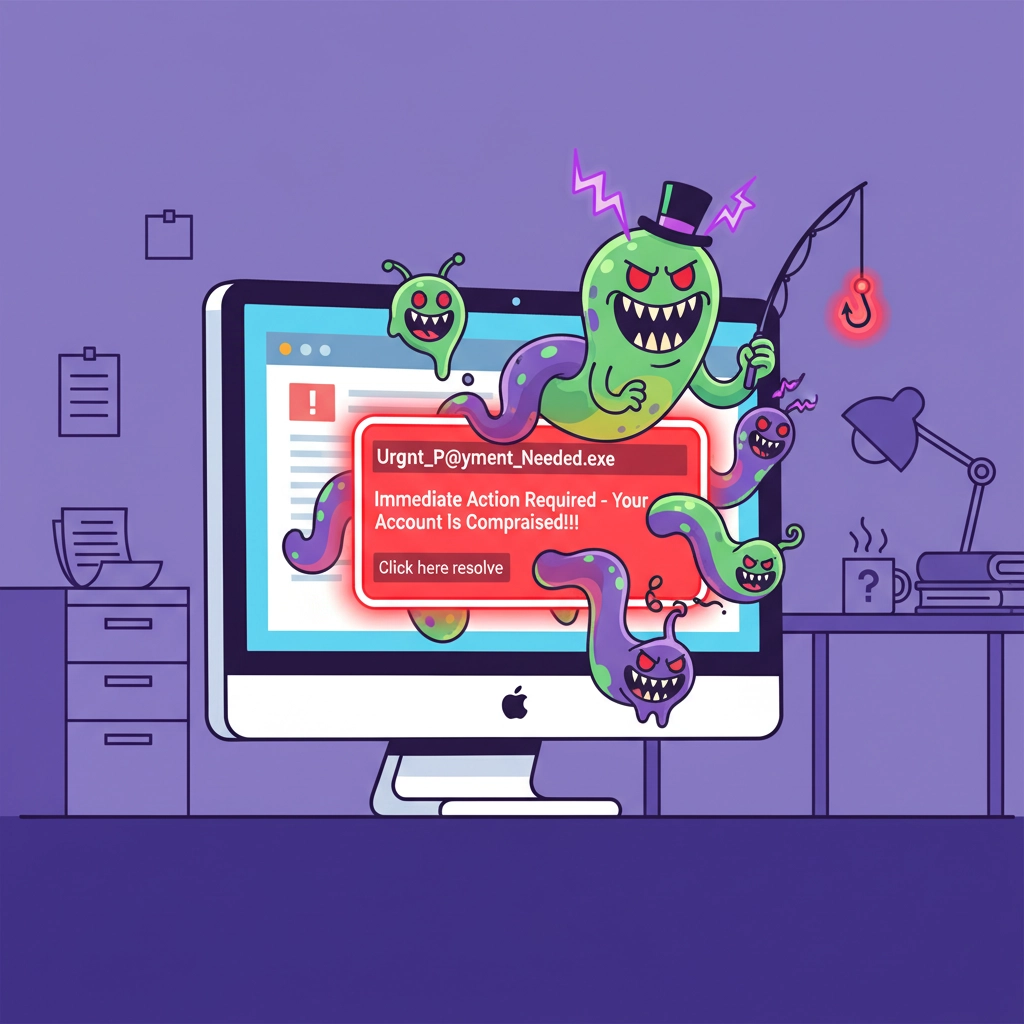

The Phishing Gateway

Most successful attacks against CPA firms begin with a seemingly innocent email. Picture this scenario: A staff member receives what appears to be a legitimate message from a client or vendor. They click a malicious link, and within minutes, your entire client database becomes encrypted and inaccessible.

This timing isn't coincidental. Cybercriminals understand that accounting firms face rigid filing deadlines, creating maximum pressure to pay ransom quickly. Average ransom demands now exceed $300,000, but the true cost extends far beyond the initial payment.

The Devastating Domino Effect

A documented case from 2024 illustrates the cascading consequences: A mid-sized Southeast accounting firm experienced a ransomware attack 48 hours before the April tax filing deadline. Over 4,000 client tax returns were encrypted, payroll data became inaccessible, and audit files were compromised.

The firm ultimately paid a $500,000 ransom to recover their files, but the damage didn't stop there. They faced:

- A $250,000 regulatory fine for non-compliance

- Multiple lawsuits from commercial clients

- Loss of their largest corporate client

- Permanent closure within 12 months

The True Cost: Beyond the Headlines

Financial Impact That Destroys Businesses

The financial toll of a successful cyberattack extends far beyond ransom payments. System downtime typically ranges from 14 to 21 days, translating to lost billable hours and missed deadlines. According to IBM's Cost of a Data Breach Study, the average breach cost reached $4.5 million in 2023, with financial services breaches averaging $5.56 million.

Perhaps most alarming: within six weeks of a significant cyberattack, almost 60% of small businesses shut down permanently. This statistic is particularly relevant for small and mid-sized CPA firms that lack the resources to absorb such devastating losses.

Regulatory Consequences You Cannot Ignore

Cybersecurity is no longer optional for accounting firms due to federal regulatory oversight. The Gramm-Leach-Bliley Act (GLBA) Safeguards Rule now applies directly to CPA firms, tax professionals, and anyone handling financial data.

Regulators expect your firm to maintain:

- A Written Information Security Program (WISP)

- Regular cybersecurity risk assessments

- Encryption and access controls

- Staff training on phishing and social engineering

Non-compliance results in fines starting at $100,000 per incident, breach notification obligations, class-action lawsuits from clients, and permanent reputation damage that can destroy decades of relationship-building.

Building Your Defense: Practical Steps to Protect Your Firm

Establish Your Security Foundation

By conducting a comprehensive cybersecurity risk assessment, you create a clear understanding of your vulnerabilities before attackers find them. This assessment should identify and test all assets that could be impacted by an attack, including hardware, systems, customer data, and intellectual property.

Critical defensive measures include:

- Maintaining a current Written Information Security Program (WISP) that documents your security protocols

- Implementing encryption protocols for sensitive data both in transit and at rest

- Establishing robust backup systems with regular testing to ensure recovery capability

- Deploying access controls that limit employee permissions based on job requirements

- Maintaining current firewall and intrusion detection systems

Empower Your Team Through Training

Since phishing remains the primary attack vector, comprehensive staff training becomes your first line of defense. Your employees must understand how to recognize phishing attempts, social engineering tactics, and proper data handling procedures.

Ensuring compliance with training requirements means teaching your team to:

- Verify requests before transferring funds or accessing sensitive systems

- Report suspicious activity immediately

- Maintain strong password practices and multi-factor authentication

- Follow established protocols for handling sensitive client information

Strengthen Third-Party Relationships

Understanding the importance of vendor management helps protect your firm from indirect attacks. By developing protocols that require third parties – including clients and service providers – to meet minimum cybersecurity standards, you create additional layers of protection.

Request security documentation from vendors and establish contractual requirements for data protection practices. This proactive approach ensures that your security efforts aren't undermined by weak links in your business ecosystem.

Secure Remote Work Environments

For firms with remote workers, establishing clear policies creates consistency across all work environments. Require employees to maintain updated firmware on home routers, use Virtual Private Networks (VPNs), implement multi-factor authentication, and secure home office environments.

Regular audits of remote access practices help identify emerging vulnerabilities and ensure ongoing compliance with your security standards.

Your Path Forward: Turning Knowledge into Protection

Integrating cybersecurity into your firm's daily operations isn't just about technology – it's about creating a culture of security awareness that permeates every aspect of your business. By regularly backing up your information, you create a safety net that allows rapid recovery from potential attacks.

Modern cyber insurance policies increasingly require documented WISPs and annual risk assessments as conditions for coverage. Policies that find firms non-compliant may deny claims entirely, leaving your organization to bear full recovery costs. Maintaining all compliance documentation and sharing relevant information with your insurance provider ensures you're protected when you need it most.

The investment in cybersecurity infrastructure and training is substantially less costly than the financial and reputational consequences of a successful breach. By taking proactive steps now, you're not just protecting data – you're ensuring your firm's ability to serve clients and maintain operations regardless of the evolving threat landscape.

Your firm's security is an ongoing process that requires continuous attention and improvement. Overwhelmed with trying to figure out how to protect your business? Don't wait for an attack to realize the importance of comprehensive cybersecurity measures. Contact us today to discuss how Logical Pros can help strengthen your firm's defenses and provide the peace of mind you need to focus on serving your clients with confidence.